Navigate property finance with confidence

Discover expert guides, market analyses, and comprehensive resources covering real estate finance, mortgages, banking solutions, and investment strategies. Stay informed with daily updates on property markets and financial trends.

Explore Finance & Property Topics

Browse comprehensive resources across all aspects of property finance

What Readers Are Saying

Join thousands who trust us for property finance insights

The mortgage guides helped me understand the entire process before approaching lenders. The articles are clear, detailed, and actually useful. I check the site every week for new content.

As someone managing multiple rental properties, I rely on the market analyses and banking features here. The content is always current and backed by solid research. Absolutely essential reading.

Finally, a finance resource that explains complex topics in plain English. The real estate section has been invaluable for understanding market conditions and timing decisions. Highly recommended.

Latest articles

Our recent publications

Explore properties like never before with real estate 3d tours

Real estate 3D tours revolutionize property viewing by offering an immersive online experience. Buyers can explore every...

Simplify your business: discover accounts receivable automation

Transforming your accounts receivable process can be a game changer for your business. By automating invoicing and payme...

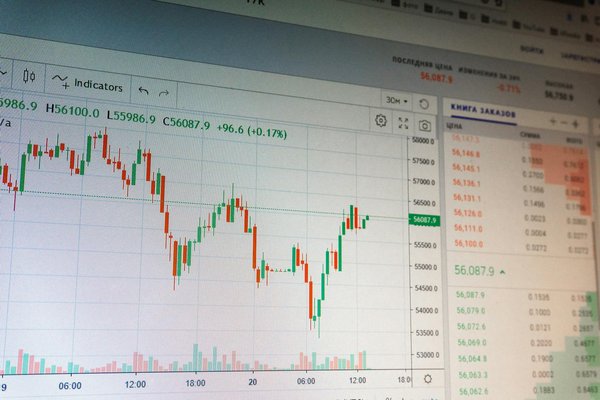

Unlock trading potential using automated expert advisors

In the fast-paced world of trading, staying ahead of the curve is crucial for success. One of the most powerful tools av...

Discover how rental guarantees can lead to financial independence in belgium

Have you ever wondered how you can achieve financial independence through real estate investments in Belgium? If so, you...

Maximize Your Trading Success with Expert Advisors for Automation

Expert Advisors (EAs) revolutionize trading by automating strategies and maximizing efficiency. They allow you to monito...

Unlock financial freedom with rental guarantee belgium

Rental guarantees in Belgium are more than a safety net; they can be your pathway to financial freedom. By ensuring secu...

Transforming global strategies: the role of the development cooperation instrument

The Development Cooperation Instrument (DCI) plays a pivotal role in shaping global strategies for sustainable developme...

How do UK mortgage holidays affect your long-term financial obligations?

In a world where financial stability can sometimes seem elusive, understanding how decisions you make today impact your ...

What are the most promising UK property markets for investors in the current economic climate?

As we navigate the current economic climate, many of you may be wondering where the most promising UK property markets a...

What should UK investors know about the tax implications of buying property through a limited company?

Property investment has become a common venture in the UK, with many investors using limited companies as investment veh...

How does the UK's Mortgage Guarantee Scheme assist buyers with small deposits?

Purchasing property is a significant financial decision that often requires substantial financial planning and saving. F...

What are the key financial factors to consider when renovating a UK property for resale?

Renovating a property for resale is a project often undertaken with the goal of maximising profit. This endeavour, howev...

Why might a UK homeowner consider a tracker mortgage in the current economic climate?

In the ever-changing landscape of the UK economy, homeowners are constantly seeking the most cost-effective and advantag...

How to create a sustainable and profitable Airbnb business with UK properties?

The sharing economy has revolutionised the way we travel, live and do business. At the forefront of this revolution is A...

Is it a good time for UK residents to invest in overseas property given the current exchange rates?

Investing in overseas property can be a rewarding, though complex venture, for UK residents. The decision is influenced ...

What are the specific mortgage requirements for UK properties with unusual construction?

Getting a mortgage can be a trying process at the best of times. When the property involved has unusual construction, th...

How Does the UK Stamp Duty Holiday Affect First-Time Buyers?

The UK government's recent announcement of a stamp duty holiday has sent ripples across the property market. For first-t...

How to Claim for Accidental Damage on Your UK Home Insurance Policy?

When accidental damage occurs in your home, it can be stressful and overwhelming. From shattered windows to water leaks,...

What Factors Should Be Considered When Insuring a High-Value Property in the UK?

Insuring a house is not just about signing a policy. It's a comprehensive process that involves understanding the value ...

How Are Changing Demographics Shaping the UK Housing Market in 2023?

In 2023, the UK housing market experienced unprecedented shifts. As the country's demographics continue to evolve, the m...

What Are the Hidden Costs of Buying a Foreclosed Property in the UK?

Buying a foreclosed property in the UK can seem like a great opportunity to snatch up real estate at a lower price point...

What Is the Potential Impact of Electric Vehicle Charging Points on UK Home Values?

As electric vehicles (EVs) grow in popularity, the infrastructure to support their use is also seeing a significant expa...

How does the green belt policy affect new housing developments in the English countryside?

There's no denying that the countryside of England, with its lush green landscape, is one of beauty and tranquility. The...

How does the Right to Buy scheme work for council tenants in Nottingham?

If you're a council tenant in Nottingham and contemplating becoming a homeowner, the Right to Buy scheme could be an app...

Navigating Planning Refusals: A Homeowner"s Guide to Challenging Council Decisions in the Lake District

When you decide to make significant changes to your home or property in the Lake District, whether it's a building exten...

Moneysworthrentals

Moneysworthrentals